Image Source – The Wandering Investor

Buying property in Kenya?

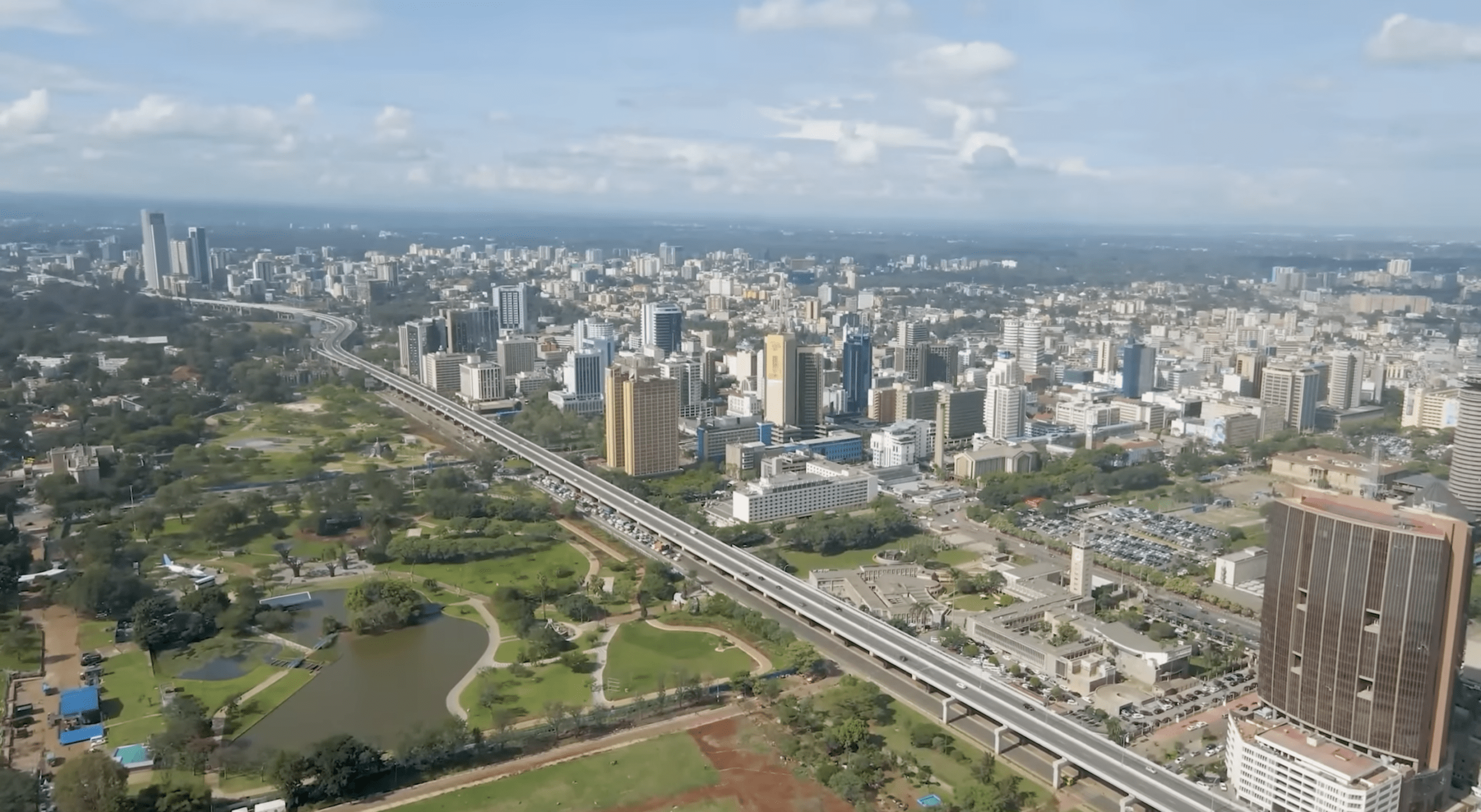

The process of buying property in Kenya represents one of the most significant financial and personal investments an individual can make. The market, characterized by its vibrancy and diversity—from the bustling urban centers of Nairobi and Mombasa to the serene coastal stretches of Diani and Lamu—offers immense opportunity. However, the process, while legally structured, demands meticulous attention to detail, a thorough understanding of the regulatory environment, and the guidance of seasoned professionals. This comprehensive guide integrates the most current information and procedures for 2025, providing a clear, detailed roadmap for both Kenyan citizens, diaspora and foreign investors. It is designed to illustrate the journey from property identification to the joyous moment of receiving your title deed, while giving you the knowledge to avoid common pitfalls and hidden costs.

Legal Foundations

For Kenyan citizens, the rights are broad, allowing for the purchase of both freehold (absolute ownership) and leasehold (ownership for a set term) titles across all categories of land—residential, commercial, and agricultural—provided all statutory procedures are followed.

For foreign nationals, the constitutional provisions under Article 65 of The Kenyan Constitution introduce specific, non-negotiable limitations. Foreigners are expressly permitted to acquire property, but the tenure is restricted to leasehold, with a maximum lease term of 99 years. This lease is renewable on the condition that the property remains economically productive and is not required for public use.

The Purchasing Process

The standard timeline for a property transaction in Kenya is approximately 30, 60 to 90 days from the signing of the sale agreement to completion, though this period can be mutually adjusted by the parties involved. The process is sequential and requires careful execution at each stage.

1. Identify a property – The process begins with a buyer identifying a property they are interested in based on their needs, preferences, research and budget.

2. Formal intent of interest – Once the buyer has found a suitable property, they can make a formal intent of interest which stipulates their offer price, terms of payment and the advocate’s details. This intent is, however, subject to the contract.

3. Letters of Offer – When the seller accepts the offer, the agent handling the sales process prepares a Letter of Offer (LOO) to reaffirm the important details agreed upon the transaction. It is, however, not legally binding and may vary. In certain circumstances it may stipulate that the buyer should at least deposit 10 – 20% of the buying price as downpayment. In other cases, it may stipulate that both parties open an escrow account where the advocates from the two parties oversee the purchase funds until the sale’s completion. It is signed between 7 – 14 days.

4. Due diligence is subject to contract – After the signing of the Letter of Offer (LOO), buyers must verify ownership and documentation of the title of the property from the seller. They can conduct this through searches at the Land Registry, Company Registry, Probate Registry, Court Records and Survey Department which is a physical investigation of the property. The buyer can also consult a licensed surveyor to verify if the land size and boundaries of the property coincide with those indicated in the deed plan.

At the same time every buyer must be aware that all the registered land is subject to certain overriding interests. These include spousal rights over matrimonial property, trusts, right of way, right of water, etc. The seller must share with the buyer important documents including the seller’s personal identification documents (ID/Passport copies) and PIN certificates. If it’s a company purchase, the certificate of incorporation and PIN Certificate would form part of the identification documents.

5. Sales Agreement – Depending on whether the property is off-plan or a completed property the transaction process varies. For ready-to-occupy properties, the transaction is completed once the deposit has been paid within a specific timeframe of 90 days from the date of signing the sale agreement. For off-plan properties, the buyer must pay a deposit followed by equal installments until the project is completed.

6. Completion – On completion, the buyers pay the full balance of property transactions in exchange for completion documents from the seller. Those opting for mortgage funding must provide a bank guarantee usually issued by the bank’s advocate. Once the buyer’s advocate receives the completion documents, they have the property assessed for stamp duty by a government valuer and subsequent stamping of transfer documents. After registration is completed, the seller’s advocate releases sale proceeds, and the buyer receives the Certificate of Title issued by the registrar to a purchaser of land

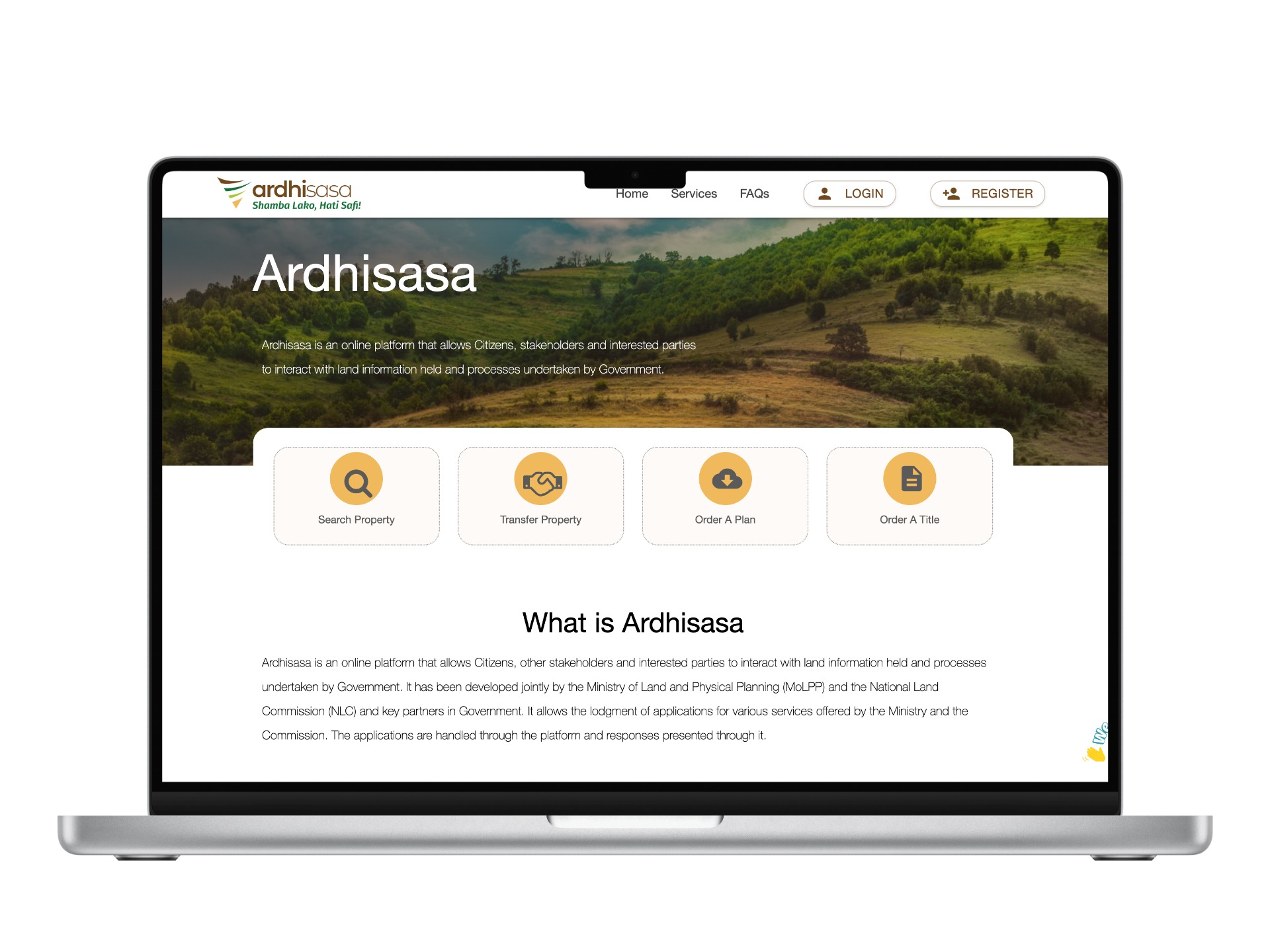

The Ardhisasa Platform – Digital Transformation of Land Services

A pivotal development in Kenya’s land administration is the full implementation of the Ardhisasa platform. This digital system aims to centralize and streamline all land-related services, enhancing transparency and efficiency. Through Ardhisasa, users can conduct official searches, request valuation for stamp duty, pay land rents and rates, and lodge documents for registration. The platform also provides a cadastral map with geospatial references for land parcels.

For foreign buyers, account creation on Ardhisasa presents a specific hurdle, as it requires a Kenyan national ID number during registration. The workaround is to contact Ardhisasa customer support directly via their helpline or website chatbot. By providing your full name, Alien ID or passport number, email address, and phone number, a support ticket is created, and an official will assist in manually setting up your account. It is important to note that Ardhisasa’s rollout is progressive; while it currently focuses on the Nairobi Registry, coverage is expanding nationwide. Properties lacking geospatial data, such as some sectional properties (apartments), may not yet be fully integrated into the system.

Comprehensive Breakdown of Costs and Fees

A prudent buyer must budget not only for the purchase price but also for the array of mandatory and incidental costs that accompany a property transaction. Underestimating these is a common and costly mistake.

- Stamp Duty – This is a significant transactional tax paid to the Kenya Revenue Authority. The rate is 4% of the property’s value for land located within a municipality or city, and 2% for agricultural land or property outside a municipality. The duty is calculated on the higher of the purchase price or the value determined by the government valuer. A special rate of 1% applies for transfers conducted via the sale of shares in a company that owns the property.

- Legal Fees – Each party is responsible for their own advocate’s fees, calculated on a sliding scale based on the property value as stipulated in the Advocates Remuneration Order. For properties up to Kenya Shillings Five Million, the fee is typically 2% of the purchase price. For higher-value properties, often between 1% and 1.5%.

- Agency Fees – Real estate agents are compensated by the party who engaged them, usually at a commission rate capped at a maximum of 4% of the property’s sale value.

- Registration and Disbursement Fees – These are the administrative costs charged by the Lands Registry for registering the transfer and issuing a new title. They are generally modest, often between KES 500 and 1,000, but must be factored in. Disbursement fees cover incidental expenses like search fees, and logistics incurred by your advocate.

- Valuation Fees – If you require a formal valuation for mortgage purposes or independent verification, a licensed valuer will charge between 0.25% and 1% of the property’s value.

- Surveyor Fees – Essential for boundary verification or subdivision, a licensed surveyor’s fees can range from KES 20,000 to over KES 100,000, depending on the complexity and location of the work.

- Statutory Clearances – Before transfer, the seller must provide clearance certificates proving all land rents and rates owed to the county government are paid in full. The cost of these arrears, if any, is often a point of negotiation between buyer and seller.

Consents, Undertakings, and Final Requirements

No property transaction can be legally concluded without obtaining all necessary consents. The most common consents include the Land Control Board Consent for agricultural land transactions, the County Land Management Board Consent where applicable, and critically, the Spousal Consent.

For buyers utilizing mortgage financing, the process involves an additional layer. The buyer’s bank will provide an Irrevocable Bank Guarantee or Undertaking to the seller’s advocate, promising to pay the balance upon completion. This is typically supported by a parallel undertaking from the buyer’s own advocate.

Frequently Asked Questions (FAQs)

Can I complete a purchase from outside Kenya?

Yes. By granting a specially drafted Power of Attorney to a trusted advocate in Kenya, you can authorize them to sign all documents and complete the transaction on your behalf. However, a personal visit for due diligence is highly recommended.

What is the single most important step in the process?

Comprehensive due diligence conducted by a qualified advocate. This is your primary safeguard against fraud and future disputes.

How do I obtain a KRA PIN as a foreigner?

This is a mandatory requirement. Apply through the KRA iTax portal or at a KRA office using your passport. You will need a local address and phone number for the registration.

Is property insurance compulsory?

While not a legal requirement for ownership, it is a critical form of risk management. Furthermore, any mortgage lender will insist on a comprehensive insurance policy as a condition of the loan.

What happens if there is a dispute after the sale?

Your signed Sale Agreement is the first reference point. Having clear terms and using advocates ensures a structured dispute resolution mechanism, typically through arbitration or the courts. This underscores the importance of a well-drafted contract.

A Call to Prudent Action

The path to property ownership in Kenya, while clearly defined, is one that demands respect for its legal and procedural intricacies. Success hinges on the synergy of expert guidance—your advocate, your agent, your surveyor—and your own informed vigilance. By approaching the process with the diligence outlined in this guide, you transform what can be a daunting undertaking into a secure and rewarding investment, laying a firm foundation for your future in Kenya. Remember, in real estate, the cost of good advice is always less than the cost of a bad transaction.

The information presented in this guide has been compiled from authoritative sources with the intent of providing a comprehensive overview of the Kenyan property market.

It is of paramount importance to understand that this document is for informational purposes only. It is not a substitute for personalized, professional legal counsel. Property transactions involve complex legal obligations and significant financial commitments; therefore, every buyer’s situation requires direct advice from a qualified advocate who can review your specific circumstances and the particulars of your intended transaction.

Join The Discussion